International currency exchange made easy

Whether you're moving overseas or managing international finances, our dedicated team offers tailored support for your international transfers. Enjoy 24/7 access to your online account and choose from over 130 currencies.

Expert support for high-value international payments

At Moneycorp, we understand that when it comes to making large international payments, you need confidence in who you choose. That’s why we provide access to competitive exchange rates, dedicated support, no transfer fees – and of course – fast delivery.

Send money online in 130+ currencies across 190 countries worldwide

Tailored support from currency experts

Online multi-currency account with 24/7 access and live FX rates

Competitive exchange rates to help your money go further

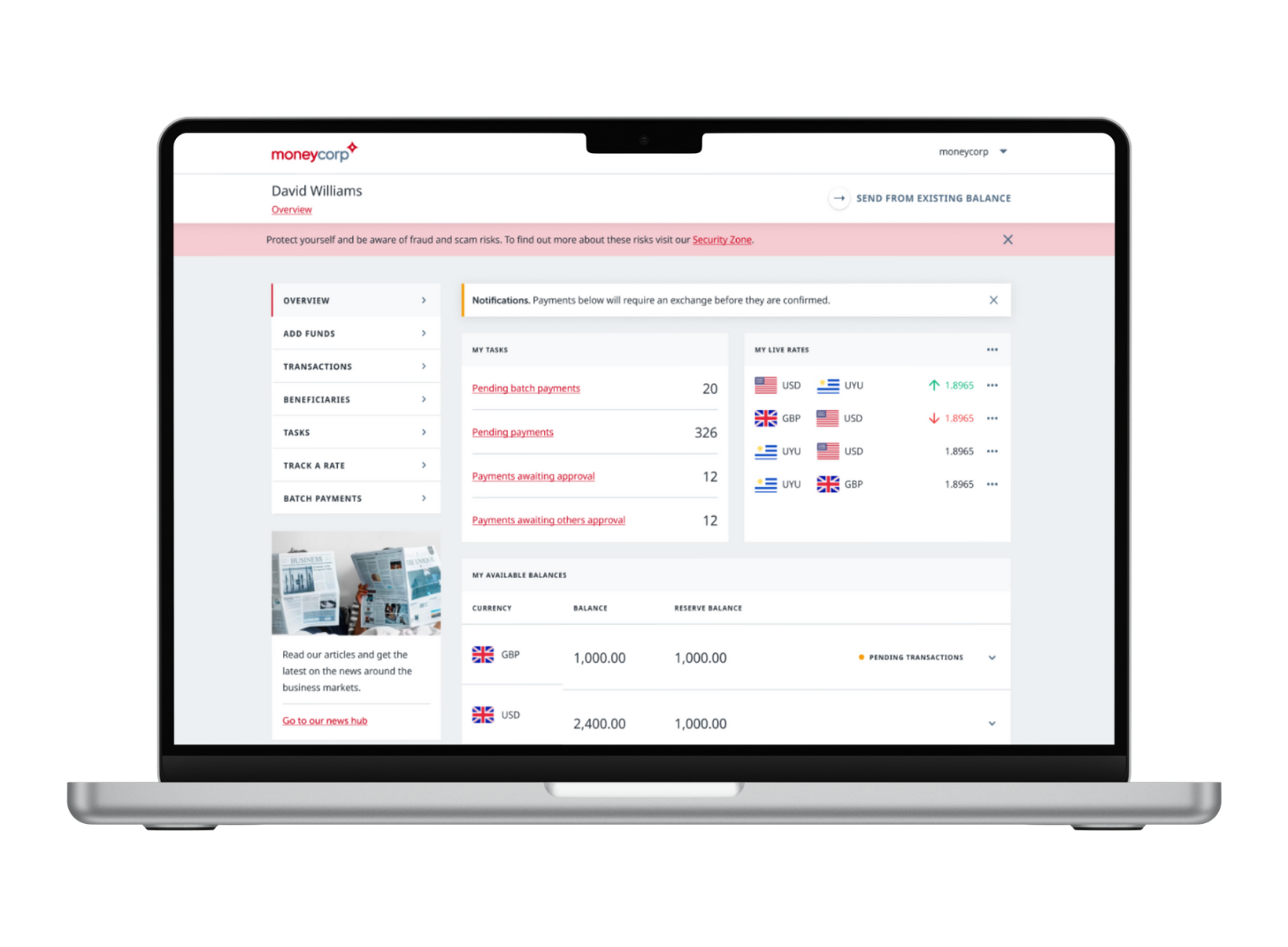

Your online account

Access your account 24/7 and send money globally with ease. Our seamless platform lets you manage international payments, view real-time exchange rates, and track every transaction from start to finish.

Getting started takes only three steps: open your account, add your recipient and payment details, and confirm your transfer. Sending payments abroad has never been more straightforward.

Specialist support

With over 45+ years of foreign exchange expertise, we’ve helped thousands of individuals move money across borders with confidence. In 2024 alone, we had a trading volume of over £79 billion, demonstrating the scale and trust our clients place in us.* Our Feefo award-winning customer service provides you with support available by phone or email.

*Trading volume represents flow measured as single leg transaction volume. These figures represent the entire Moneycorp Group, taken from the group annual report 2024.

Common reasons for large international payments

Buying property abroad

Whether you're investing in a holiday home, relocating, or expanding your portfolio, international property purchases often require large payments. We make cross-border transactions simple, fast, and reliable.

Create account

Overseas investments

Managing overseas investments often involves large payments for asset purchases or to fund transfers. Moneycorp combines speed, technology, and expertise to keep your transactions running efficiently.

Create account

Retirement abroad

Planning your retirement in another country often involves large financial transfers for property, residency, and lifestyle setup. Our seamless payment services help you settle into your new life with peace of mind.

Create account

Tools to manage your currency risk

Forward contracts may require a deposit. A forward contract* allows you to agree a fixed exchange rate for a future transfer when facilitating payment for goods, services, or direct investment.

FAQs

How can I transfer money online safely?

You can transfer money online using trusted currency transfer companies. Our platform supports international transactions, including SEPA payments and IBAN-based transfers, ensuring your funds are sent efficiently.

What is the best way to send money internationally?

The best overseas money transfer method depends on your needs. We facilitate fast international payments, SEPA transfers, and FX exchange services tailored for private clients.

What is an IBAN and why do I need it?

An IBAN (International Bank Account Number) is used to identify bank accounts across borders. It’s essential for international bank-to-bank transfers and SEPA payments that your money reaches the correct recipient.

What are SEPA payments and who can use them?

SEPA (Single Euro Payments Area) payments allow for fast euro transfers across Europe. Clients with a euro-denominated account can use SEPA transfers for efficient money overseas transfers.

Can I send payments to and from my UK bank account via my Moneycorp online account?

Yes, you can send and receive international payments directly into your UK bank account through your Moneycorp online account using your IBAN or SWIFT code. Our platform supports global money transfers and international transactions with full visibility of your transactions.

What’s the difference between currency transfer and money currency exchange?

International currency transfer refers to sending money abroad, while money currency exchange involves converting one currency to another. Our service combines both, offering seamless international payment and currency exchange services.

How do I send money transfers online quickly?

With our Moneycorp's online account you can make an online money transfer in just a few steps:

- Create an account or log in.

- Enter recipient details including IBAN or bank information.

- Choose the currency and confirm the FX exchange rate.

- Send money internationally with ease.

We make online transfers fast, easy and effortless.